Our Website Leaves Your from the Driver’s Seat

Helping consumers as you get to their economic wants is we perform, for this reason , our company is equipping your with your expert perception, tips, and you can pointers to acquire there.

- Home loan Things

- Home buying Solutions

- Lifestyle & Domestic

- Re-finance Options

- APM Insider

Cash-aside refinance

The brand new financing pays off the initially financial, given that leftover money will pay out of financial obligation. The lending company tend to sometimes shell out one to loans in direct a lump share or provide the debtor the bucks to blow it off on their own.

Though your interest in your home loan are lowest, this option will save you morebining higher varying interest rate loans toward you to definitely repaired-speed commission could save you money every month. it may help you save money ultimately.

Speed and you may term re-finance

A speeds and you may term re-finance is what it may sound such as for instance. The brand new financing includes less interest and you may a beneficial long https://paydayloansconnecticut.com/mystic/ run, perhaps even starting more with a new 30-year mortgage.

This might be a powerful way to handle large rates, particularly when men and women pricing have really made it problematic for one to help make your monthly home loan repayments.

You’ll be able to utilize the more money you are not purchasing for the your mortgage payment to simply help lower your own outstanding loan quantity for the highest-attention handmade cards, medical expenses, or any other mortgage stability.

House collateral credit line (HELOC)

A great HELOC makes you borrow on the latest security on the house in the place of altering the rate and identity of your current mortgage. This is exactly a terrific idea if you signed your loan at an effective price but nevertheless have to availability their collateral.

You should use the quantity you acquire for several things, eg renovations or settling large interest financial obligation. A good HELOC really works differently away from an everyday financial in that your pay only as you put it to use.

The great benefits of Refinancing

You can find huge advantages when you re-finance your financial. You might repay highest-attract financial obligation, tend to in the a smaller time period. Your credit rating also work with, that you can build since your loans shrinks.

You are able to put the currency it can save you with your new lower interest on your debt percentage perform. This enables one to pay these loan balances much faster.

One of the primary benefits to knocking down it personal debt was that it does give you certain respiration place. Combining obligations reveals your own credit cards support, taking a cushion in the eventuality of emergencies.

These are issues, it is possible to make use of the money you will be preserving monthly so you can establish their rainy-time money. In that way there are money on hand getting big commands and does not need trust credit cards in the 1st set.

And you can let us keep in mind on the comfort. All the amount borrowed features an alternate deadline, interest rate, and you will harmony. By combining the debt, you could clarify the process of investing it off. There’ll be an individual payment during the an interest rate that’s a great deal more positive than just large-appeal credit cards.

Facts to consider Before you Re-finance

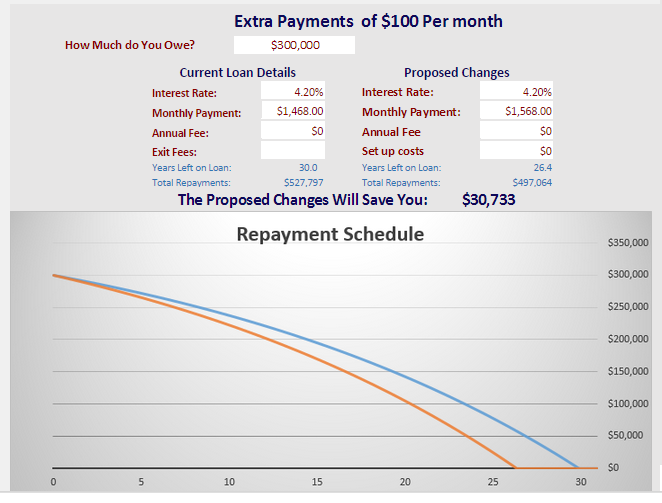

Naturally, given that you’re going to be credit more your existing financial harmony, their month-to-month home loan repayments could be higher. When you find yourself considering the pros and downsides regarding debt consolidation reduction re-finance, consider it this way: Sure, their monthly mortgage payments could well be high, will from the just a few hundred bucks. However with a lowered rate of interest and just one fee so you’re able to generate, this new coupons can provide more benefits than the purchase price.

Still, you ought to make sure that this is a payment per month your are able. A debt negotiation financing will even mean you may be using way more mortgage attention along side longevity of the loan. However,, once again, you have to weighing you to definitely up against your high-attract credit cards. And also you do not deduct mortgage interest tied to the most other an excellent bills.

One more thing to imagine is how a lot of time you’ve planned so you can remain in your home. A debt negotiation re-finance tends to make sense should you decide to help you stay for a while. However if you are not, you will have faster guarantee of your property when you decide so you’re able to promote, which means that less cash on your own pouch.

The fresh new mortgage would be to own a 30- or fifteen-seasons fees months, so you will need to ensure that you’re more comfortable with their conditions.

A cash-away refinance including includes charges. Closing costs usually normally add up to between dos% and you will 6% of your own financing.

If you find yourself believe draw guarantee from your home to benefits large desire obligations, click on this link for the majority resources and you may things should consider earliest.

When you are suffering from mounting loans therefore individual property, today is the time to place your home guarantee so you can be right for you. Debt consolidation reduction helps you reduce high-desire credit cards, scientific expense, and other mortgage stability and supply financial rescue today.

If you want to connect that have an APM Mortgage Coach towards you to review your options, click on this link .