Ash Grove Tree Surgery

Your Eastbourne Tree Surgeon

Exactly what Certified Software Are around for Kentuckians?

- Advance payment: Always step 3% in order to 20% or maybe more

- Mortgage insurance rates: PMI needed in the event that down-payment is below 20%

Have there been Bodies-Supported Finance Offered?

Yes, the new Government Houses Administration (FHA), a portion of the U.S. Company from Homes and Metropolitan Advancement, also offers loans which have lower down costs and you can borrowing from the bank criteria, causing them to good for very first-time homeowners. Continue reading

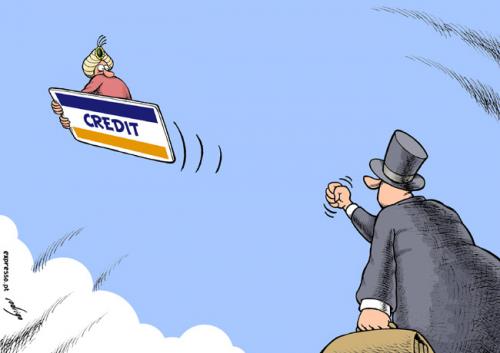

As to why modifying your home financing could be a sensible flow

Maybe you’ve regarded as altering your home mortgage to another lender to save some funds? Dependent on your circumstances, that might be a smart circulate. Think about this:

Can you really save money of the modifying?

Yes it will save you currency if you get a reduced interest whenever modifying mortgage brokers. Not only can your own monthly cost be down, but so tend to the quantity of desire possible pay more living of the financing. It is people savings toward focus that will improve biggest improvement into the enough time-name earnings.

Particularly, let’s say you still owe R1 mil on your own home loan, are repaid over another 15 years. At the an interest rate out-of 8%, the eye along the left label of the financing might be just over R720,000. If you were to https://paydayloanalabama.com/paint-rock/ switch to a lender providing you with an excellent 7% interest, you can save yourself an impressive R102,000 in total desire over fifteen years. Even though you caused it to be just an excellent 0.5% loss of their interest rate (to help you 7.5%) you’ll save yourself more R51,000.

How much does changing involve?

Once you key your house loan to a different bank, you are efficiently trying to get a brand name-new home financing. You must look at the exact same steps since you performed along with your fresh home loan. Therefore, you ought to violation value and you may borrowing from the bank monitors, and also have the the brand new thread registered toward deeds office. Discover monetary and additionally timing effects.

A different way to open the value of your home is to help you switch to a loan equal to the newest well worth

From a repayment point of view, you’re going to be responsible for the latest judge charges to change and you may check in the fresh new bond, which includes charge levied by the a bond membership attorneys. Continue reading