Ash Grove Tree Surgery

Your Eastbourne Tree Surgeon

Basic Thoughts Count: Glee And you may See Customers

- Display with the:

- Share towards Linkedin

- Visit us on the Instagram

Several times, the answer is the fact financial institutions only didn’t entice consumers very early enough regarding the software technique to cause them to become complete the onboarding travels.

Loan providers must ensure software was done and you will agreeable, but for people, benefits especially the time for you incorporate is vital, states Rodrigo Silva, President, Americas at Temenos. A modern onboarding sense must balance the three.

Time is actually Everything

Here are some onboarding questions creditors commonly ask: What exactly is their cell phone number? What exactly is your own Societal Defense Number? What’s their driver’s license count? What is actually your modified revenues stated on your last three years out of tax returns?

When you are all four questions tends to be relevant whenever onboarding a different buyers or user, after you inquire such concerns along the way is actually a switch reason for whether or not the user completes the program.

Cell phone number: An easy task to respond to. SSN: Together with simple, regardless of if customers may suffer uncomfortable getting you to suggestions until he is confident. Driver’s license count: Most likely needs grabbing the bag. Tax statements: A notably big inquire.

Silva suggests tempting customers and you will gaining pick inside by the requesting easier-to- offer information right up-side, moving to far more mid-level desires including uploading a photograph of their license. Continue reading

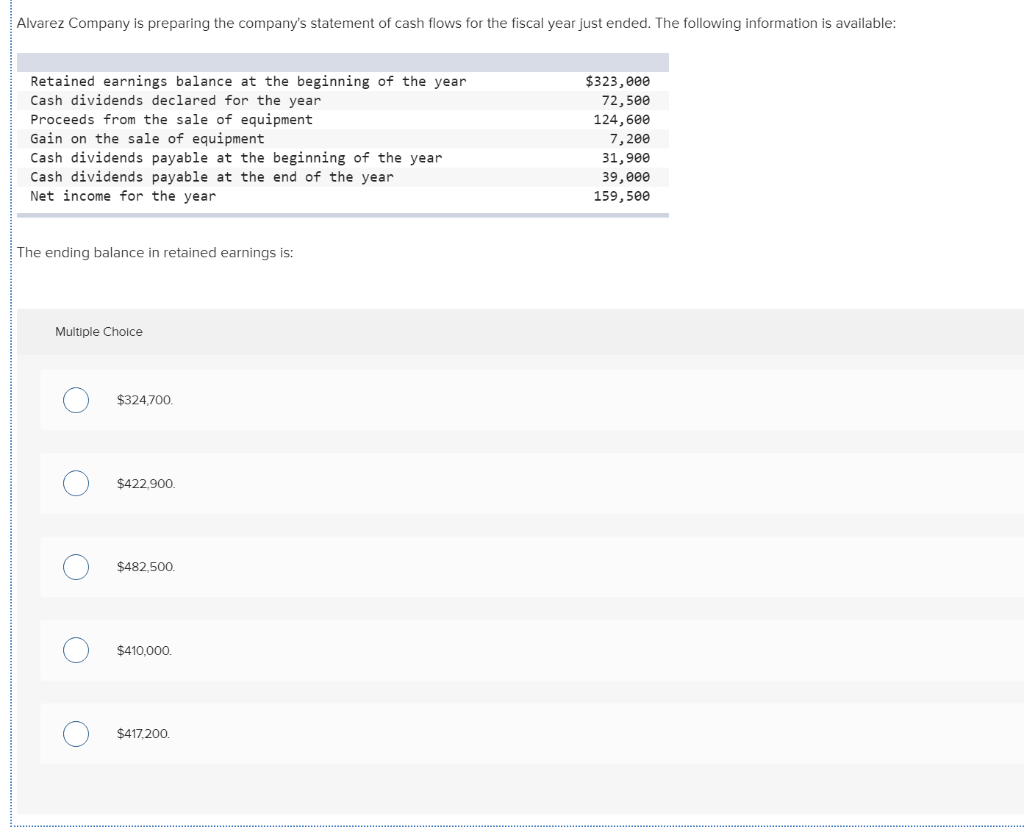

Point 80 C Deduction Of INR 150,000

Secret Takeaways

You happen to be an NRI now, but you may decide to spend their wonderful decades on your homeland. An enthusiastic NRI mortgage is key to leading a financially safer retired lives during the Asia to possess such as somebody. For example resident Indians, you could acquire taxation experts lower than some parts of brand new They Operate, together with Section 80C, 24(b), and 80 EE. Continue reading to learn more regarding the NRI Mortgage tax benefits.

Once the an enthusiastic NRI, you might be residing to another country to make the most of a job solutions. However may wish to come back to your homeland sometime during the the near future. To this end, you may also decide on their international money to order good possessions in Asia. Yet not, your own house condition might have your wondering whether you can find loan providers to cover your property for the India. Not only can you come across Lenders and you may lenders ready to financing your perfect of buying a property inside the India, but you can and additionally take advantage of all types of income tax deductions open to Citizen Indians for the Home loans. This informative article listings aside every NRI Mortgage taxation masters you ought to know regarding. Continue reading to find out.

NRI Home loan Tax Positives

One Indian source individual, whether a citizen or a keen NRI purchasing a house inside the Asia, can also enjoy multiple income tax gurus on their investments. Continue reading